Economic uncertainty puts pressure on mid-market businesses in Vietnam

Grant Thornton Vietnam

29th December 2023

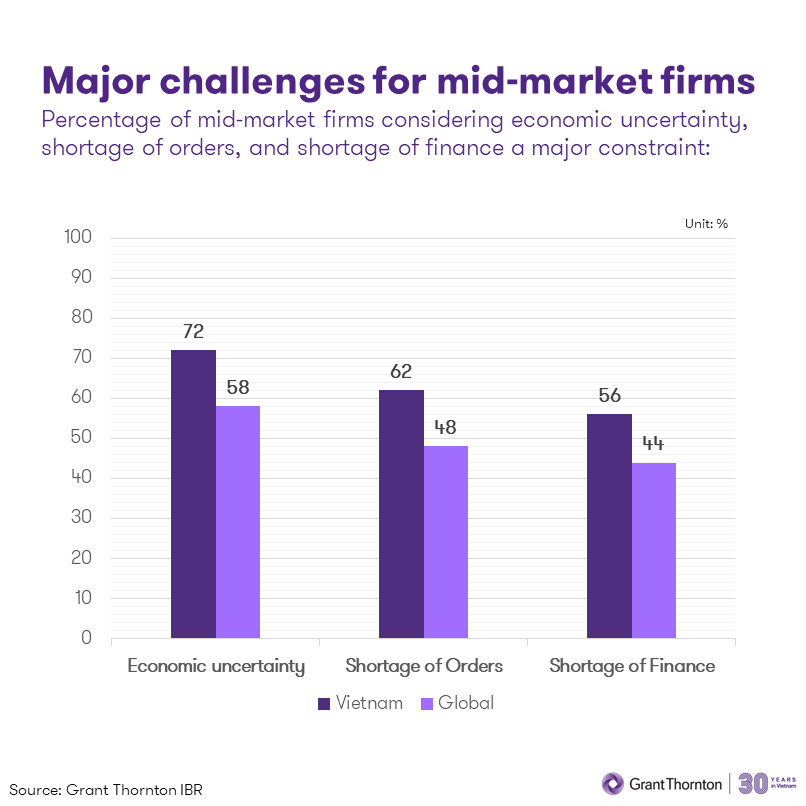

The second story of the International Business Report (IBR) campaign, reporting results of Grant Thornton’s survey of the global mid-market, pointed out the difficulties experienced by mid-market firms, particularly in Vietnam.

Please Login or Register for Free now to view all updates and articles

In addition to free-to-view updates and articles, you can also subscribe to the full Legal Centrix Vietnam Service including access to:

- Overview notes on the law

- Thousands of high quality translations of legislation covering all key business areas

- Legal and tax updates

- Articles on important legal and tax issues

- Weekly email alerts

- Sophisticated web platform and search

Legal Centrix is trusted by top law and accounting firms.

Grant Thornton Vietnam

- Vietnam

- www.gt.com.vn

Grant Thornton Vietnam’s Key Differentiators

Grant Thornton in Vietnam is a leading provider of national audit, tax, advisory and outsourcing services. With 2 offices and 260 employees, we apply strong technical guidance and breadth of experience to ensure that clients receive a truly different experience.

We focus on delivering tangible value to customers

A leading international consulting firm that provides a complete range of services including audit, tax, advisory, business risk and outsourcing services.

- Long and strong presence in Vietnam since 1993, with offices in Hanoi and Ho Chi Minh City.

- Adding value to clients performance through profitable and functional solutions based on practical experience and local expertise.

- Focusing on a thorough understanding of clients ambitions, high-quality customised services and personalised relationships.

- Strategic and structured approach to deliver insightful and systematic analysis for effective, unbiased decision making.

- Professional project management and risk management to ensure quality deliverables and successful establishment of any new business facility including significant involvement from experienced Partners.

- Approved by SSC to audit Public Interest Entity in security sector in Vietnam.

- The only foreign invested firm in Vietnam that holds a Business Valuation License from the Ministry of Finance.

Click here to view the author's profile

Author

-

Grant Thornton Vietnam

Vietnam

Tags

Related Content

- No related content

Recent updates

- Decree 356/2025/ND-CP On Detailed Regulations On A Number Of Articles And Measures For Implementing The Law On Personal Data Protection

- Vietnam: Mediation in Intellectual Property disputes

- Vietnam: Recent Regulations On Auctioning Land Use Rights For Residential Land Allocation, Capital Contribution Activities in Credit Institutions, and Personal Data Protection

- Vietnam: Third-party funding in the resolution of investment-related disputes: A financial risk-reduction method for doing business with Europe

- Vietnam: Shareholders’ agreements indirectly recognized via beneficial ownership

- Vietnam: Electronic signatures in investment registration dossiers: Inevitability and practical challenges