Vietnam: Amended Law on Corporate Income Tax

KPMG Vietnam

9th July 2025

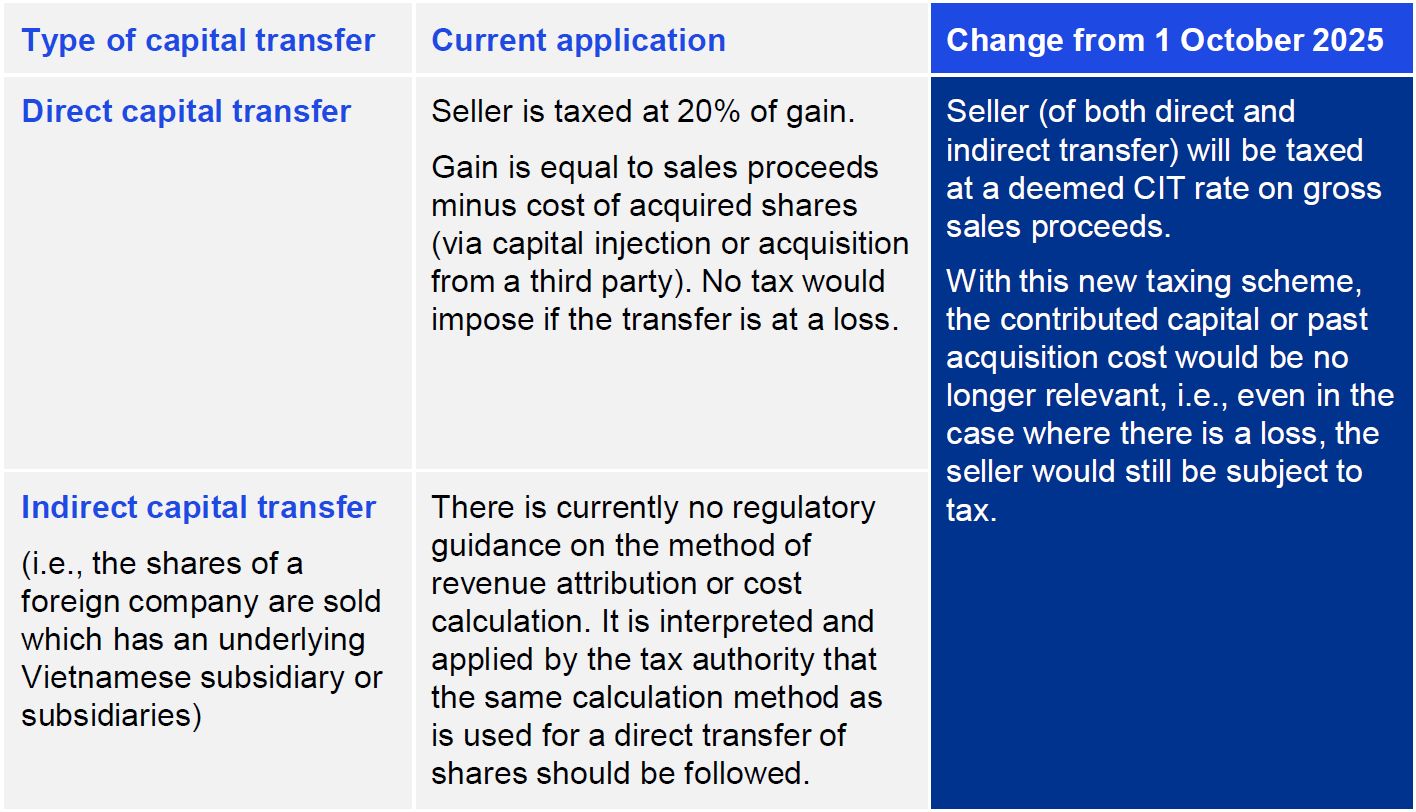

The amended Law on Corporate Income Tax has just been passed by the National Assembly on 14 June 2025 and will be effective from 1 October 2025. One of the key changes included in the Amended CIT Law is a major revision to the basis of taxation for income derived by foreign corporate shareholders from capital transfers, whether directly or indirectly, in the form of shares in non-public joint stock companies or invested capital in limited liability companies in Vietnam.

Please Login or Register for Free now to view all updates and articles

In addition to free-to-view updates and articles, you can also subscribe to the full Legal Centrix Vietnam Service including access to:

- Overview notes on the law

- Thousands of high quality translations of legislation covering all key business areas

- Legal and tax updates

- Articles on important legal and tax issues

- Weekly email alerts

- Sophisticated web platform and search

Legal Centrix is trusted by top law and accounting firms.

KPMG Vietnam

- Vietnam

- kpmg.com.vn

We Set Standard In The Industry

Global network with 197,263 people in 154 countries

️

Click here to view the author's profile

Author

-

KPMG Vietnam

Vietnam

Tags

Related Content

- No related content

Recent updates

- Vietnam: Mediation in Intellectual Property disputes

- Vietnam: Recent Regulations On Auctioning Land Use Rights For Residential Land Allocation, Capital Contribution Activities in Credit Institutions, and Personal Data Protection

- Vietnam: Third-party funding in the resolution of investment-related disputes: A financial risk-reduction method for doing business with Europe

- Vietnam: Shareholders’ agreements indirectly recognized via beneficial ownership

- Vietnam: Electronic signatures in investment registration dossiers: Inevitability and practical challenges

- Vietnam: Customs Alert - Circular No. 121/2025/TT-BTC on Customs procedures and Tax administration for import and export goods