On 26 March 2024, the Income Tax (Amendment) Bill 2024 and Labuan Business Activity Tax (Amendment) Bill 2024 (collectively, “Bills”) were passed by the House of Representatives. Both Bills introduce amendments in relation to e-invoicing, with the Income Tax (Amendment) Bill 2024 proposing additional amendments in relation to, among others, capital gains tax and the revision of estimate of tax payable. This legal alert sets out the key amendments introduced by the Bills.

Income Tax (Amendment) Bill 2024 (“Income Tax Bill”)

The Income Tax Bill proposes several amendments to the Income Tax Act 1967 (“ITA 1967”) including, among others, the following:

1. Capital Gains Tax (the amendments in relation to capital gains tax will be effective from the date the Income Tax (Amendment) Act 2024 comes into force)

New definition of “capital assets”

At present, “capital asset” is widely defined under the ITA 1967 as “moveable or immovable property including any rights or interests thereof”.

Following paragraph 38 of Schedule 6 of the ITA 1967, gains or profits from the disposal of a capital asset situated in Malaysia are exempted from tax except for disposals of:

- unlisted shares of companies incorporated in Malaysia; and

- shares of foreign incorporated companies deriving value, directly or indirectly, from real property in Malaysia (“Section 15C Shares”),

collectively, (“CGT Exemptions”).

Proposed amendment under the Income Tax Bill:

The Income Tax Bill proposes the redefinition of “capital asset” to expressly set out the types of capital assets that are subject to capital gains tax as well as the consequential removal of the CGT Exemptions.

The proposed new definition of “capital asset” is set out below:

- movable or immovable property situated outside Malaysia including any rights or interests thereof; or

- movable property situated in Malaysia which is a share of a company incorporated in Malaysia not listed on the stock exchange (including any rights or interests thereof) owned by a company, limited liability partnership, trust body, or co-operative society.

The second limb of the new definition clarifies that gains or profits from the disposal of unlisted shares of Malaysian companies by individuals are not subject to capital gains tax under the ITA 1967.

Definition of “shares”

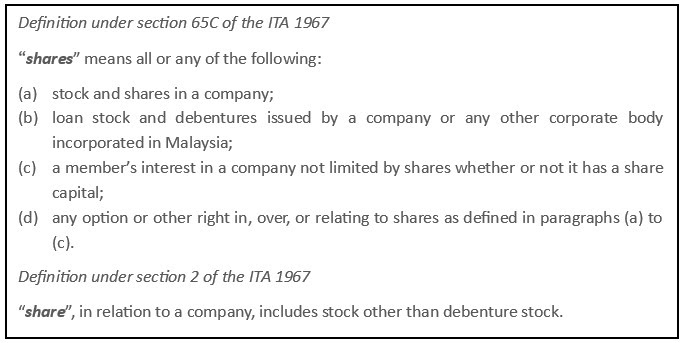

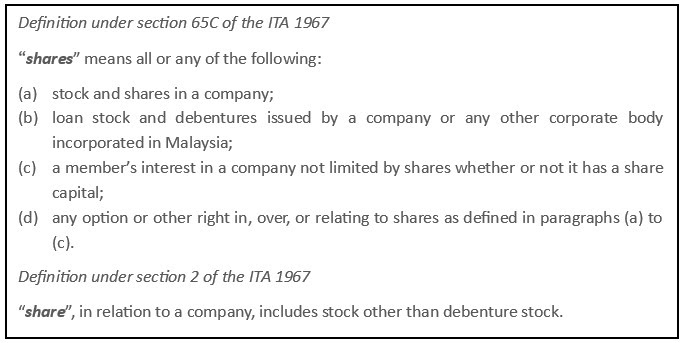

The Income Tax Bill proposes the deletion of the definition of “shares” under section 65C of the ITA 1967 and, for purposes of calculating capital gains tax, that the existing definition of “shares” under section 2 of the ITA 1967 shall apply:

The proposed amendment is consistent with the Inland Revenue Board’s (“IRB”) explanation of “shares” in the Guidelines for CGT on Unlisted Shares issued by the IRB (“Guidelines”).

Persons subject to the scope of Section 15C Shares

At present, the imposition of capital gains tax on gains or profits from the disposal of Section 15C Shares applies to a “person”. Under the ITA 1967, a “person” includes a company, a body of persons, a limited liability partnership, and a corporation sole, where a "body of persons" means “an unincorporated body of persons (not being a company), including a Hindu joint family but excluding a partnership”.

Proposed amendment under the Income Tax Bill:

The Income Tax Bill proposes that section 15C(1) of the ITA be amended such that a disposer of Section 15C Shares which is subject to capital gains tax is specified as a “company, limited liability partnership, trust body or co-operative society”. The proposed amendment makes clear that persons other than a company, limited liability partnership, trust body, or co-operative society such as individuals are not subject to capital gains tax.

Definition of “defined value” for the purpose of Section 15C Shares

At present, “defined value”, for the purpose of Section 15C Shares, is defined under section 15C(5) of the ITA 1967 as “the market value of real property or the acquisition price of shares of another controlled company as determined under subsection 15C(2)”.

Proposed amendment under the Income Tax Bill:

The Income Tax Bill proposes that reference to subsection 15C(2) in the definition be replaced with subsection 15C(4), in line with the definition of “defined value” under the Guidelines.

2. Revision of estimate of tax payable (effective from the year of assessment 2024)

In line with the introduction of a third opportunity for companies, limited liability partnerships, trust bodies, or co-operative societies to submit a revision of tax payable for a year of assessment in the eleventh month (in addition to the sixth and ninth months), the Income Tax Bill proposes that the definition of the term “revised estimate” in section 107C(7) of the ITA 1967 is updated to reflect this. The current definition only refers to the revised estimates made in the sixth and ninth months of the basis period.

3. E-invoicing (effective from 1 January 2024)

Removal of restriction to issue printed receipts to buyers

The Income Tax Bill proposes the amendment of section 82(2B) of the ITA 1967 which, at present, requires any person who is required to submit a consolidated transaction invoice to the Director General of Inland Revenue (“Director General”) to issue a printed receipt to buyers.

The Income Tax Bill proposes that the restriction for such receipts to be issued in printed form be removed.

Self-billed invoices to be issued by e-commerce platform providers

In addition to the above, the Income Tax Bill introduces a requirement for electronic trading platform providers to issue self-billed invoices in accordance with such conditions as may be imposed by the Director General (“Amendment on Self-billed Invoices”).

This is consistent with the provision in the Implementation of E-Invoice in Malaysia (Frequently Asked Questions for the E-Commerce Industry) issued by the IRB, paragraph 2 of which provides that it is the e-commerce platform provider, rather than the merchant or service provider, which is responsible for issuing a self-billed e-invoice to record the merchant and/or service provider’s income earned from transactions concluded through the e-commerce platform.

Labuan Business Activity Tax (Amendment) Bill 2024 (“Labuan Income Tax Bill”)

The Labuan Income Tax Bill seeks to amend the Labuan Business Activity Tax Act 1990 by introducing provisions similar to the Amendment on Self-billed Invoices under the Income Tax Bill, which will be deemed to come into effect on 1 January 2024.

Moving Forward

Businesses are advised to familiarise themselves with the amendments introduced by the Bills and assess the implications that such amendments will have when they come into force. In particular, against the booming e-commerce landscape, current e-commerce platform providers as well as potential entrants seeking to ride on this wave, should ensure that they have the necessary resources and expertise to comply with the e-invoicing obligations introduced by the Bills when they come into effect.

The information provided is for information purposes only and is not intended to constitute legal advice. Legal advice should be obtained from qualified legal counsel for all specific situations.

|