Cambodia: Clarification on Administrative Fines for Enterprises Employing Foreign Employees without Work Permits

DFDL Cambodia

7th November 2022

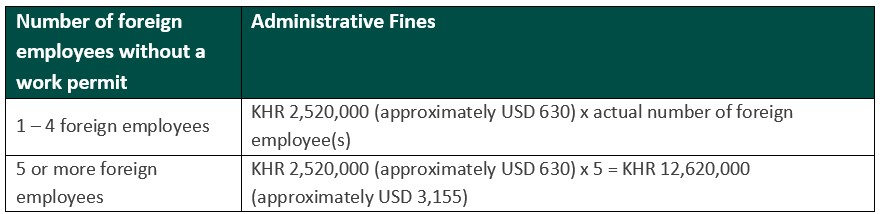

On 9 September 2022, the Cambodian Ministry of Labour and Vocational Training issued Guideline 3005 on Administrative Fines for Owners or Directors of Factories, Enterprises or Establishments that Employ Foreign Employees without Work Permits and Employment Cards.

Please Login or Register for Free now to view all updates and articles

In addition to free-to-view updates and articles, you can also subscribe to the full Legal Centrix Vietnam Service including access to:

- Overview notes on the law

- Thousands of high quality translations of legislation covering all key business areas

- Legal and tax updates

- Articles on important legal and tax issues

- Weekly email alerts

- Sophisticated web platform and search

Legal Centrix is trusted by top law and accounting firms.

DFDL Cambodia

- Cambodia

- dfdl.com

DFDL established its headquarters in Cambodia in 1995. DFDL is licensed as an investment company by the Council for the Development of Cambodia and the Cambodian Investment Board. We are also registered as a private limited company with the Ministry of Commerce. Under these licenses and registrations, we are permitted to provide business consulting, tax and investment advisory service of an international nature.

On 1 March 2016, DFDL and Sarin & Associates joined forces and established a commercial association and cooperation in order to form a new business transactions platform to serve clients with interests in Cambodia and across the expanding ASEAN marketplace.

DFDL and Sarin & Associates have worked together for over 10 years in Cambodia. Sarin & Associates has long been recognized for providing advice to companies in Cambodia in several sectors, such as telecommunication, energy, retail, real estate, financial services, banking, etc.

Our clients are major international and Asian foreign investors in Cambodia, including large foreign and Asian financial institutions. We have been involved in major projects in Cambodia including electricity projects, aviation, telecommunications, infrastructure projects and large real estate projects.

Click here to view the author's profile

Author

-

DFDL Cambodia

Cambodia

Tags

Related Content

- No related content

Recent updates

- Circular 33/2025/TT-BKHCN On Regulations On Criteria For Enterprises Implementing Electronic Device Production Projects To Enjoy Corporate Income Tax Benefits

- Decree 293/2025/ND-CP On Regulations On The Minimum Wage For Employees Working Under Labour Contracts

- Decree 291/2025/ND-CP On Amending And Supplementing A Number Of Articles Of Government Decree No. 103/2024/ND-CP Dated 30th July 2024 Regulating Land Use Fees, Land Rental Fees And Government Decree No. 104/2024/ND-CP Dated 31st July 2024 Regulating The Land Development Fund

- Vietnam: New Regulations on the Transfer of Land Lease Rights under the 2024 Land Law

- Vietnam: Key Highlights of the New Circular on Opening and Using Overseas Foreign-Currency Accounts by Institutional Residents