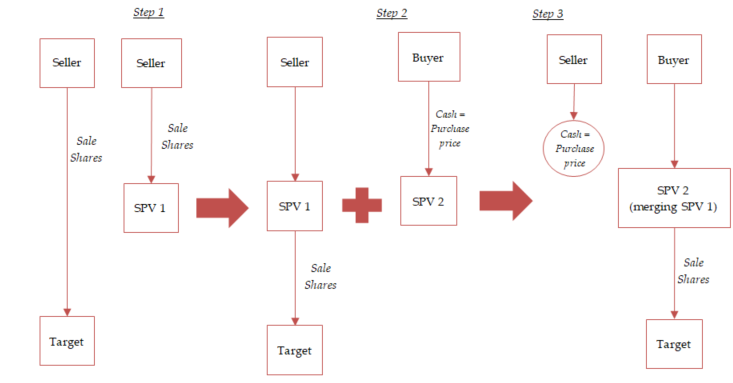

New structure to overcome tender offer requirements under Vietnam securities law

Venture North Law Firm

30th July 2021

Under the Securities Law 2019, a proposed buyer (the Buyer) who wish to acquire 25% or more of total shares (the Sale Shares) of a public company (the Target) must comply with tender offer requirements.

Please Login or Register for Free now to view all updates and articles

In addition to free-to-view updates and articles, you can also subscribe to the full Legal Centrix Vietnam Service including access to:

- Overview notes on the law

- Thousands of high quality translations of legislation covering all key business areas

- Legal and tax updates

- Articles on important legal and tax issues

- Weekly email alerts

- Sophisticated web platform and search

Legal Centrix is trusted by top law and accounting firms.

Venture North Law Firm

- Vietnam

- https://www.vnlaw.com.vn/

Venture North Law Limited (VNLaw) is a Vietnamese law firm established by Nguyen Quang Vu, a business lawyer with more than 17 years of experience. VNLaw is a boutique professional law firm focusing on corporate, commercial and M&A practices in Vietnam. Our goal is to be an efficient, innovative and client-friendly firm. To achieve that goal, we are designing a working environment and a compensation system which encourage our lawyers to provide more efficient services to clients and to focus on the long term benefit of the firm.

Click here to view the author's profile

Author

-

Venture North Law Firm

Vietnam

Tags

Related Content

- No related content

Recent updates

- Law 133/2025/QH15 On High Technology

- Vietnam: Reform of work permit regulations under Decree No. 219/2025/ND-CP: A breakthrough for companies and foreign employees in Vietnam

- Vietnam: Legal Framework for the Tokenized Asset Trading Market in Vietnam

- Vietnam: Do Social Networks Need to Register or Re-Register Under Vietnam’s New Decree 147/2024?

- Vietnam: Decree 219/2025/ND-CP: Key changes in the management of foreign workers in Vietnam

- Law 139/2025/QH15 On Amending And Supplementing A Number Of Articles Of The Law On Insurance Business